Fixed deposit (FD) is a popular investment option for those who are looking for guaranteed returns on their savings. It is a low-risk investment option and an attractive choice for those who are seeking stability in their financial portfolio.

Types of FD

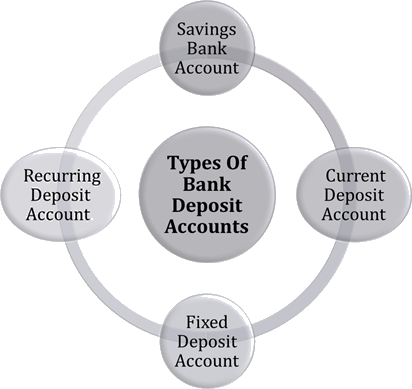

Fixed deposit is a popular form of investment, but there are several other forms of FD available, including recurring deposit (RD) and tax-saving FD. RD allows individuals to invest a fixed amount of money on a monthly basis, while tax-saving FD provides a tax rebate under Section 80C of the Income Tax Act.

Features of FD

The interest rate on FD varies depending on the tenure and the amount invested. FDs offer compound interest, which is calculated on the initial deposit and any interest earned. The tenure of FDs can range from 7 days to 10 years. Premature withdrawal of FDs is allowed, but it is subject to a penalty.

Eligibility criteria for FD

To be eligible for FD, individuals must meet certain criteria, including age, citizenship, income, and having a bank account. Most banks have a minimum age requirement of 18 years, and the minimum deposit amount can vary from bank to bank.

Advantages of FD

FD offers several advantages, including guaranteed returns, low-risk investment, flexibility in tenure and deposit amount, and liquidity. The stability of FDs makes them a popular choice for those who are seeking to secure their financial future.

Disadvantages of FD

While FDs offer stability and security, they also have several disadvantages. One major disadvantage is the low-interest rate compared to other investment options. Premature withdrawal of FDs is subject to a penalty, and the maturity amount may not be reinvested in a flexible manner.

Conclusion

FD is a safe investment option for those who are seeking stability and security in their financial portfolio. However, it is important to research and compare different FD options before investing to ensure that you receive the best returns on your savings. There are also other investment options available that offer higher returns, but they may be riskier. Ultimately, the decision to invest in FD or any other investment option depends on an individual’s financial goals and risk tolerance.

Overall, FDs can be a useful tool for managing personal finances, especially for those who are looking for a low-risk investment option. Before investing in an FD, it is important to consider the tenure, interest rate, and penalties associated with premature withdrawal. Additionally, individuals should carefully consider their financial goals and risk tolerance when making investment decisions.